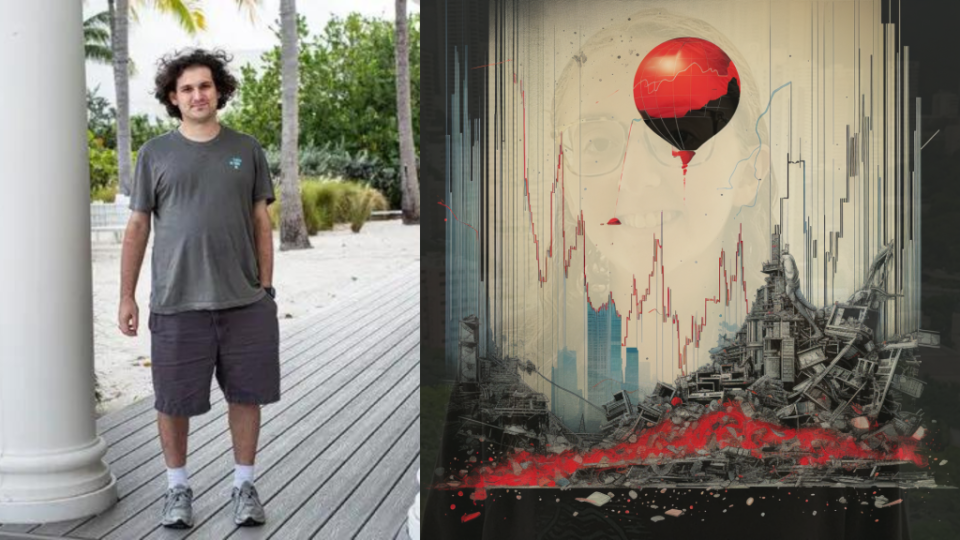

Trial Day 9: Trial Day 9: Ever wondered who’s behind the intriguing moniker “SBF” in the cryptocurrency world? Meet Sam Bankman-Fried, a once-celebrated figure who steered FTX to unprecedented heights, only to witness its dramatic downfall in November 2022. In this comprehensive guide, we’ll explore the highs and lows of SBF’s journey. From co-founding FTX and accumulating a staggering net worth to facing legal turmoil and a trial that has sent shockwaves through the crypto community.

Curious about the charges against SBF, the impact of FTX’s collapse on the crypto market, or the key revelations from the ongoing SBF trial? Get ready for an insider’s look into the life and controversies of Sam Bankman-Fried. If you’ve ever asked “What did SBF do?“, “How bad was FTX by SBF“, or even “How’s the SBF trial going“, this guide is where we address these questions and more.

Buckle up for a ride through the cryptic world of high-stakes finance and the captivating saga of SBF.

Who is SBF, aka Sam Bankman-Fried?

Sam Bankman-Fried is a controversial figure in the financial and cryptocurrency realms. He garnered widespread recognition as the co-founder and former CEO of FTX, a once-thriving crypto exchange. Known by the moniker “SBF,” he steered FTX to become one of the world’s largest cryptocurrency platforms. He attained a staggering personal net worth that eclipsed $26 billion. However, the zenith of his digital currency empire met an unexpected demise in November 2022. This marked a pivotal moment in his career and for crypto in general.

The unraveling of Bankman-Fried’s financial ventures commenced with his resignation from FTX on November 11, 2022. Subsequently, FTX filed for Chapter 11 bankruptcy, signaling a profound shift in the cryptocurrency landscape. The collapse of FTX was exacerbated by a CoinDesk report that underscored potential leverage and solvency concerns intertwined with Alameda Research, another venture associated with Bankman-Fried.

This development sent shockwaves through the volatile crypto market. It saw a substantial loss of billions and a market valuation below the significant $1 trillion mark. The abrupt fall of FTX in November 2022 not only punctuated the challenges faced by major players in the crypto industry but also raised questions about risk management and regulatory considerations in the evolving landscape of digital finance.

Sam Bankman-Fried’s Past

Sam Bankman-Fried, born on March 6, 1992, into an academic family on the Stanford University campus, embarked on a trajectory marked by intellectual prowess and diverse experiences. Sam’s early life hinted at an environment fostering intellectual curiosity. He was raised by professors Barbara Fried and Joseph Bankman, and with familial ties to academic luminaries such as his aunt Linda P. Fried, the dean of Columbia University Mailman School of Public Health.

His journey into mathematics led him to the Canada/USA Mathcamp. This is a program for mathematically talented high-school students. This was before he pursued his high school education at Crystal Springs Uplands School in Hillsborough, California.

After graduating from the Massachusetts Institute of Technology (MIT) in 2014 with a bachelor’s degree in physics and a minor in mathematics, Bankman-Fried delved into the financial realm. He commenced his professional journey as an intern at Jane Street Capital during the summer of 2014. This is also where he traded international ETFs. Post-graduation, he then returned to Jane Street full-time before making a significant move in September 2017. Relocating to Berkeley, California, he briefly contributed to the Centre for Effective Altruism (CEA) as the director of development.

However, it was in November 2017, spurred by fund injections from notable figures like Jaan Tallinn and Luke Ding, that Bankman-Fried co-founded Alameda Research, a quantitative trading firm. By 2021, he held approximately 90 percent ownership of Alameda Research.

His early forays into cryptocurrency trading and arbitrage set the stage for his later ventures. This includes a notable $25 million per day trade to exploit Bitcoin price differentials between Japan and the United States. In April 2019, Bankman-Fried founded the FTX cryptocurrency derivatives exchange, which would later play a central role in his narrative.

SBF and FTX

Sam Bankman-Fried founded the FTX cryptocurrency derivatives exchange in April 2019. This marks the inception of a venture that would soon become a prominent player in the cryptocurrency industry. The platform officially opened for business the following month.

Although by December 8, 2021, Bankman-Fried found himself alongside other industry executives, testifying before the Committee on Financial Services, emphasizing the increasing influence of FTX in shaping the regulatory discourse around cryptocurrency.

Strategic Financial Moves and Investments (May 2022 – September 2022):

In May 2022,